Appx Medicaid Payment Reconciliation

Overview

The Medicaid Payment Reconciliation System (MPR) from APPX Software, Inc is used to reconcile Medicaid Client payment information available to State of Florida Counties. Each county in Florida is required to repay a portion of the Medicaid costs of eligible recipients that are living in a nursing home or receive hospital care. The State of Florida provides a listing (bill) for the clients the county may be liable for and the county’s share for each of those clients. The State also provides access to this data electronically via a downloadable file. While the State verifies each client’s last known address, it remains the County’s responsibility to verify the eligibility of each client and to make sure the client is a resident of that county. Manually reconciling the information the State sends each month can take hours to weeks depending on the volume of transactions. That’s where the MPR system can help. The billing information your county receives is also available through the Internet as a download file. By using that file the MPR system can help you save time and money. The system helps reduce processing time by eliminating over-payments and increasing your efficiency, accuracy, and productivity. How? Processing time is saved by letting MPR do the work for you. It’s estimated that 90% of the transactions are for clients that reside in nursing homes. Each month you have to verify that you have a valid Certificate of Residency (COR) for each of these clients. With the MPR system you add a Certificate of Residency (COR) record (or address information for hospital clients) once, set an eligibility flag, and let the MPR system verify the addresses. The 90% that are okay will go through each month without any intervention. You maintain complete control. If a client moves or otherwise becomes ineligible, simply change their eligibility flag and no payments will go through without your approval. With hundreds of clients to review each month, it is easy to miss errors. You may approve a payment for a client that is not from your county, or you may pay for the same service period more than once. Letting MPR validate each request for payment guarantees that you will not accidentally pay for a client you have not verified. MPR lets you enter COR information for each client. Any client without a COR or coded as ineligible will be flagged to deny payment. The MPR system will look for duplicate payments. As each month is processed, a history file is updated with all the payments, whether approved or denied. All new requests are matched against this history file to ensure you do not pay twice for the same service period. To find out more about Appx, please go to our web site, http://www.appx.com- Appx Medicaid Payment Reconciliation

- Overview

- Starting Appx and the Reconciliation System

- Medicaid Payment Reconciliation Administration Menu (Main Menu)

- Medicaid Payment Reconciliation Menu

- Certificate of Residency

- Hospital Per Diem

- Reporting

- Bill Processing

- Reconciliation Overview

- Download the monthly bill

- Name and save the bill in the Download Folder

- Update COR File

- Move Billing File To Server

- List Raw File To Verify

- Import Payment File and Build Exception List

- Review Exception List and Flag Denials

- Edit Payment Records/Change Payment Code

- Trail Balance (Future Release)

- Post Reconciled Bill

- How to upload the reconciled bill

- Special Functions Menu

- Terminology

- Exception Reasons

-

- Not this county

- No COR on file. -- NP code updated

- Resident record not set for NH

- Missing required value(s)

- Per Diem values not found

- Per Diem mismatch

- Resident hospital flag not set

- Address does not match

- No address record

- County share is more than the bill amount

- Unpaid record for client

- No record in history for credit offset

- Adj, check for matching credit/debit bills

- No eligibility code

- Coded as ineligible

- Rebill payment previously approved

- Duplicate service date record in history

- Service date is prior to medicaid admit date

- Service date is later than date of death

- Service date is later than date moved out

-

- Tips and Techniques

- Known Bugs

- Feature Request

- Overview

Starting Appx and the Reconciliation System

AppxFigure: Appx Client Login Screen

On the Remote tab you must enter your Desktop user id in the Login field, your desktop Password, the name of the Appx server, and the port. The Appx Client software remembers your user id, server name, and port, but you must enter your password every time you wish to log in to Appx. All of these fields are required. Click Connect after entering all the login information and Appx will start. The Local tab is used to connect to a copy of Appx that is installed on a local computer. The Options tab has settings for controlling the visual effects of the Appx Client display. Please call support at 1-800-879-2779 for more information regarding the Options and Local tabs. When Appx starts one of the following screens will appear depending on the version of Appx you are using.

Figure: Appx Menu, Version 4.2 and Above

Figure: Appx Menu, Version 4.1.a and Below

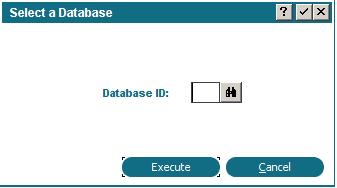

From either menu you can start the MPR system, alter the Appx environment, or modify the MPR programs. There may be times you want to maintain or modify the system however someone from Appx will be helping you with that. To start the MPR system for reconciliation click on either Run or Run an Application (depending on the Appx Menu), and enter the three character “Database ID” for your county. Each county has a different Database ID. You can click on the binoculars and search the list to find the Database for the MPR system.

Figure: Select Database ID Screen

After entering or selecting the Database ID press enter or click Execute and the MPR system will start and the MPR Medicaid Payment Reconciliation Administration Menu will appear.

Medicaid Payment Reconciliation Administration Menu (Main Menu)

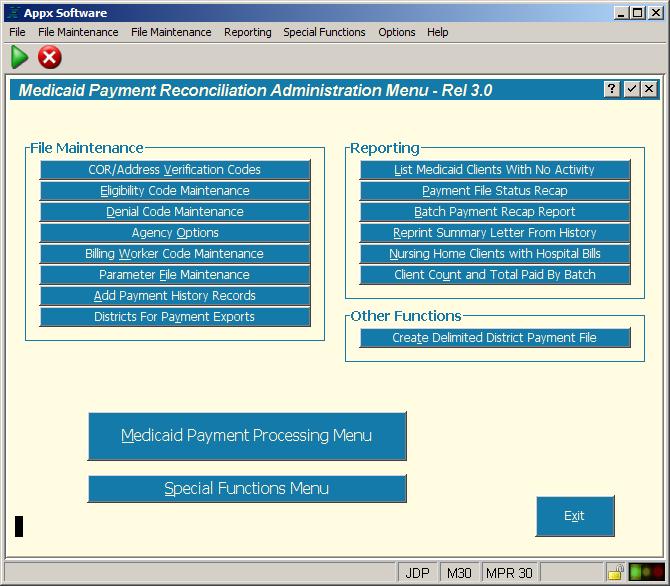

There are several options available on main menu. These options are grouped by functionality.Figure: MPR Medicaid Payment Reconciliation Administration Menu (Main Menu)

File Maintenance Functions

File Maintenance functions allow you to customize and configure your application.COR/Address Verification Codes

This function will allow you to define and maintain code(s) you assign on the COR record for identifing the method or source of information you used to evaluate and set the eligibility for the client. For example, if you used a phone book to determine if this client is a county resident you might have a code of PH or PB.Eligibility Code Maintenance

Maintain the code(s) for designating the client’s eligibility. Eligibility is assigned on the COR maintenance screen. Defining COR records and identifying eligibility is the cornerstone of the MPR system. You can have multiple codes for eligibility, check the Auto Except box if this eligibility code designates and exception record that must be reviewed.Denial Code Maintenance

These codes are set by the State. This function is designed to maintain these pre-determined codes. If the State adds or deletes a code you can quickly modify this table using this function.Agency Options

This is where you enter your county’s specific information. Much of this information is printed on the Reconciliation Summary Report. You also identify your county number to the MPR system. This is very important because the county number entered on the Agency Options screen is compared to every record in the billing file. If the number aren't the same the record will be listed as an exception.Billing Worker Code Maintenance

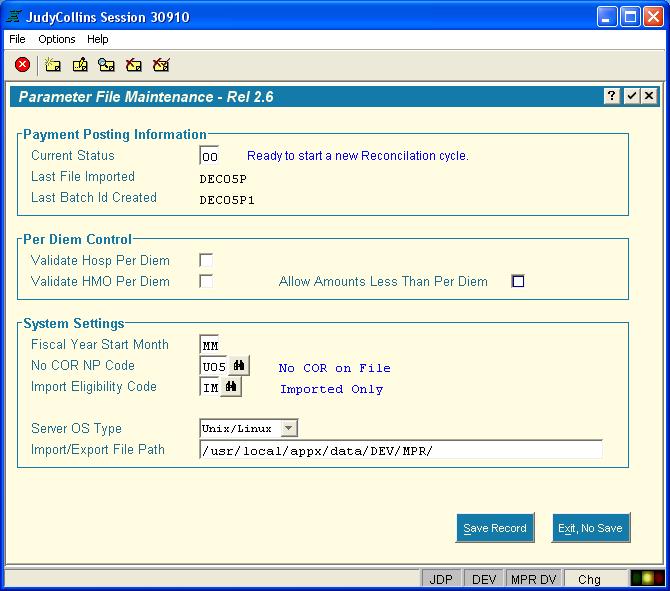

Enter the initials and full name of the people in your county that mainain the MPR system. The user’s ID is automatically added to audit information within the system.Parameter File Maintenance

Figure: Parameter File Maintenance Screen

This input process is used to maintain your MPR system settings. Caution should be taken before changing any settings on this screen. The Payment Posting Information section contains information about the reconciliation cycle (batch). Reconciliation is a multi-step process. Steps need to completed in order. The Current Status field is an internal pointer indicating which step you are currently in. The MPR system will automatically change as you proceed through reconciling your monthly bill. Please do not change this number unless someone from Appx asks you to do so. The Last File Imported is the name of the bill that you are either working on just finished. Last Batch ID Created is the internal name the MPR system gave the batch you imported. A digit is added to provide uniqueness if another batch for the month is reconcilied. Per Diem Control. This section enables or disables the per diem editing feature of the MPR system. Per diem checking is optional and by defualt is disabled. To use this feature you must set these fields then import all the available per diem files from the State (see below for details), also, as new per diem files become available you must import them as well. System Settings. Fiscal Year Start Month can be set to your fiscal period starting month. There are a few reports that can be sorted by fiscal year. No COR NP Code, identifies the default denial code the MPR system puts on incoming billing records that do not have a COR record on file. Import Eligibility Code is the default eligibility code you wish to have placed on imported COR records. The Server OS Type is for identifying the operating system (OS) type. The MPR system needs this to determine the OS command structure syntax. Import/Export File Path is the complete OS path to your MPR system data directory. If the Appx system is moved to another location on the current server or move to a different location on another server this path must be changed.

Add Payment History Records

This input process allows you to enter data into the history files. Use this function to add billing history from bills that were not reconciled using the MPR system. MPR will automatically maintain a history for each batch processed.Reporting Functions

Most reports comprise a multi-process step. Depending on the design of the report some of these steps may be bypassed. The first step is to obtain the constraints of the data. The second step will allow you to control sort order. Step three lets you define print characteristics such as printer name, form name, etc. By default reports are displayed on your screen prior to physically printing the report on a printer.List Medicaid Clients With No Activity

List’s clients with COR records that have no billing history. If you added a COR and there is no history something might be wrong with the COR record keys. Us this report to check for this condition and investigate the reason why no billing records have accessed this history information.Payment File Status Recap

Print a summary list of the current batch you are reconciling. This report shows client information, payment code, and amounts either paid or denied.Batch Payment Recap Report

This report is the format of the Payment File Status Recap report but allows you to select records from history rather than the current cycle batch.Reprint Summary Letter From History

This report allows you to print the Summary letter showing total paid and denied by billing type for any bill you have reconciled. This report also runs automatically after a batch is posted, see below.Nursing Home Clients with Hospital Bills

List nursing home clients that also have hospital billing records in history.Client Count and Total Paid By Batch

List the count of clients assisted within a date range. Also totals the amount paid or denied for the period defined.Other Menus

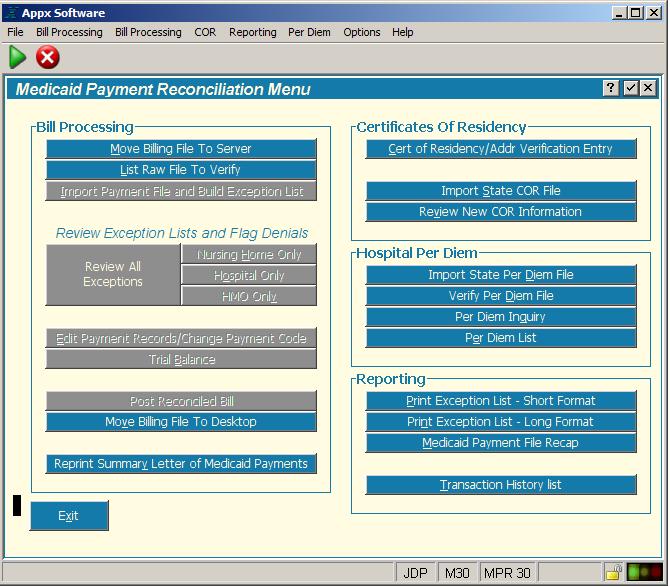

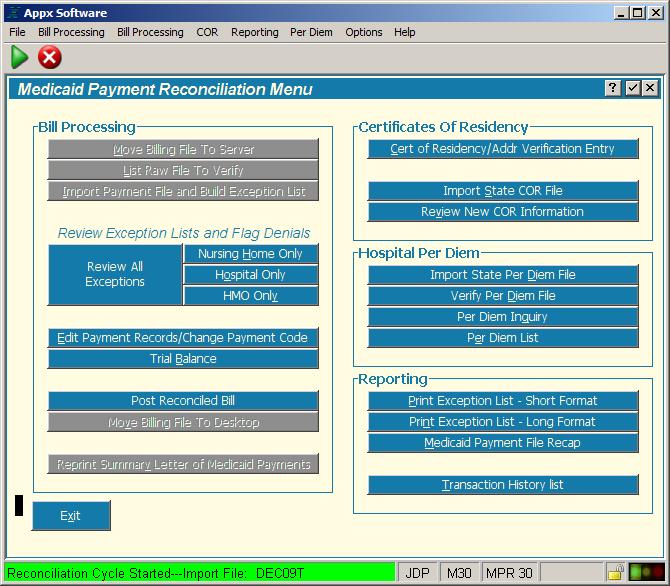

The large button, Medicaid Payment Processing Menu, will invoke the reconciliation menu. The Special Functions Menu is for performing unique task.Medicaid Payment Reconciliation Menu

Figure: Reconciliation Menu

Certificate of Residency

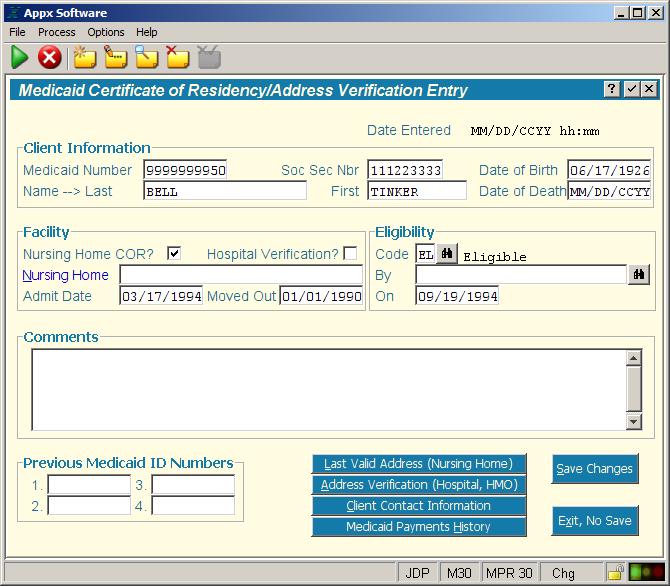

The Certificate Of Residency section is where you maintain Certificate of Residency (COR) records. As each client record in the monthly bill is read by the MPR system, it is checked against the COR file. If a matching COR record is found and that COR record is flagged as Eligible (EL) then this billing record will not be listed as an exception. Instead the billing record will be passed and will not appear on the exception list. Notice updating or adding COR records is not part of the reconciliation process. You can, and should, maintain your COR file periodically throughout the month. Having a robust COR file will save you a lot of time each month reconciling the bill.Cert of Residency/Addr Verification Entry

Figure: Certificate of Residency Screen

You can add or change COR record information on this screen. The COR file can be updated with live records from the bill. This might be the easiest and fastest way to keep your COR file up to date. While processing the bill you can have the MPR system create a COR record for you. Most of the information in the COR record is populated with the data from the billing record. All you need to do is mark the eligibility status. Also from this screen you can invoke other process. Last Valid Address (Nursing Home) is where you can record the clients last known address prior to entering the nursing home. Address Verification (Hospital, HMO) for entering the hospital address. Client Contact Information for storing the clients’ legal representative and public assistance case worker. Medicaid Payments History shows prior activity for this client. A COR record must be identified as being a nursing home COR and/or a Hospital COR. There are two check boxes in the Facility section of this screen for identifying the type of COR verification intended for this client. Nursing home COR's are common and will be the predominate type of COR records in your COR file. Hospital COR’s are different. Because of the high dollar amount of hospital and HMO bills you may want to review each record individually each month. In that case you would not define a hospital COR, however, if you wish, you can create a hospital COR and mark it eligible. As with nursing home, hospital and HMO billing records matching and eligible COR will not be listed on the exception list. A COR can be both a nursing home and hospital COR.

Import State COR File

Currently the State does not produce a importable COR file.Review New COR Information

This process lists all the newly imported COR records from the State. Each COR must be reviewed for eligibility. The COR file will be updated with the incoming record if the COR is accepted. This process is tied to the Import State COR File which is currently not being used. This function is currently not used since there is no importable file from the State.Hospital Per Diem

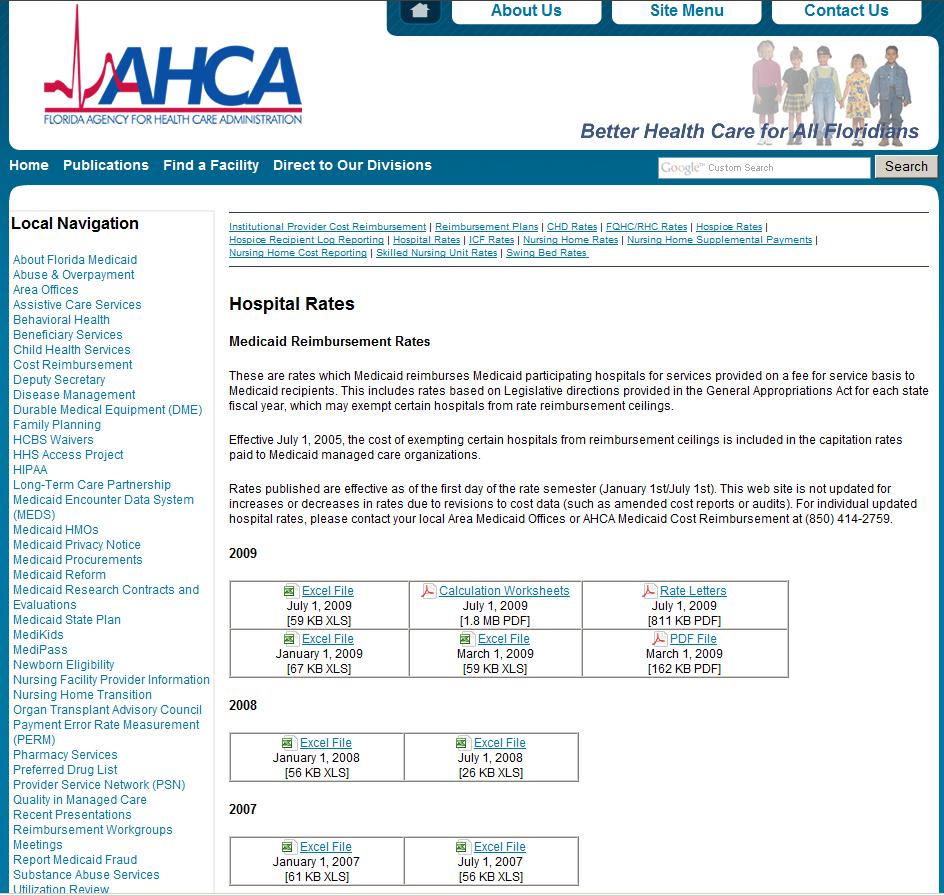

The Hospital Per Diem section contains processes that allow you to import and inquire the State per diem rates. *Hospital rates are rates which Medicaid reimburses Medicaid participating hospitals for services provided on a fee for service basis to Medicaid recipients. This includes rates based on Legislative directions provided in the General Appropriations Act for each state fiscal year, which may exempt certain hospitals from rate reimbursement ceilings. Effective July 1, 2005, the cost of exempting certain hospitals from reimbursement ceilings is included in the capitation rates paid to Medicaid managed care organizations. Rates published are effective as of the first day of the rate semester (January 1st/July 1st). This web site is not updated for increases or decreases in rates due to revisions to cost data (such as amended cost reports or audits). For individual updated hospital rates, please contact your local Area Medicaid Offices or AHCA Medicaid Cost Reimbursement at (850) 414-2759. *This information is taken from the AHCA web site.Hospital Per Diem Overview

The Appx Medicaid Reconciliation system can import the Medicaid Reimbursement Rates and optionally check the hospital/HMO billing records to ensure the amount charged matches the pre-set per diem rate. If the rate does not match then the record will be listed on the exception report with an appropriate message. You then decide to pay or not pay (reimburse) based on your county‘s criteria. Please take note that Per Diem editing is an optional feature. By default the MPR system will not validate Per Diem. See the detailed instructions Activating Per Diem Editing below to activate this feature. If Per Diem checking is active on your system ensure that all the relevant files have been processed before importing your monthly bill to avoid unnecessary records and messages on the exception list.Downloading the Hospital Per Diem

Download the Per Diem import data file at; http://www.fdhc.state.fl.us/Medicaid/cost_reim/hospital_rates.shtmlFigure: AHCA Web Site for Downloading Per Diem

Per Diem files are under the heading Hospital Rates on this web site. The file you download includes all the providers within Florida. There are not specific files for each county as with the bill. The file will download as a spreadsheet (xls, Excel). Open this file with Excel and save it as a tab delimited text file to the /Download directory. Name the file using the standard MMMYYx format. For example, JAN05H . Use H to identify this file as a hospital per diem file. Important note: There are several years/semesters available for downloading. You will need to download files to cover the anticipated service dates for the billing records you are currently receiving from the State.

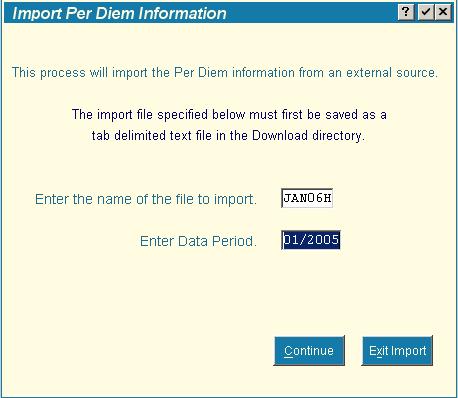

Import State Per Diem File

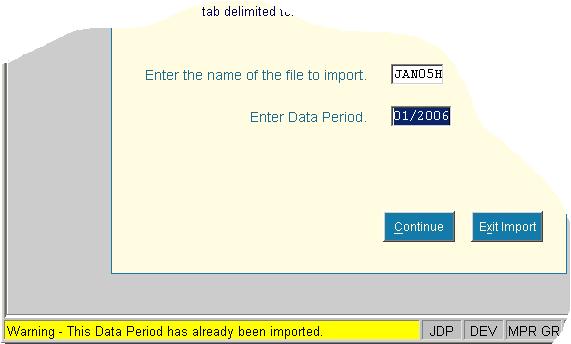

The file you downloaded from the internet and saved in the /Download directory needs to be imported into the Medicaid Reconciliation system. The import process reads each record in the downloaded file and saves the information to a file in the MPR system. Click the Import State Per Diem File. The following screen pops up. There are two fields that must be entered. The first field is the name of the file you downloaded and saved (MMMYYx format) in the /Download folder. The second field is for the semester, enter either 01 or 07 and the year. See next section for details.

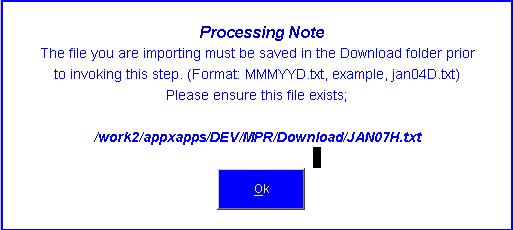

If the name of the file to import cannot be found in the /Download directory a message similar to the following will be displayed.

There are two fields that must be entered. The first field is the name of the file you downloaded and saved (MMMYYx format) in the /Download folder. The second field is for the semester, enter either 01 or 07 and the year. See next section for details.

If the name of the file to import cannot be found in the /Download directory a message similar to the following will be displayed.

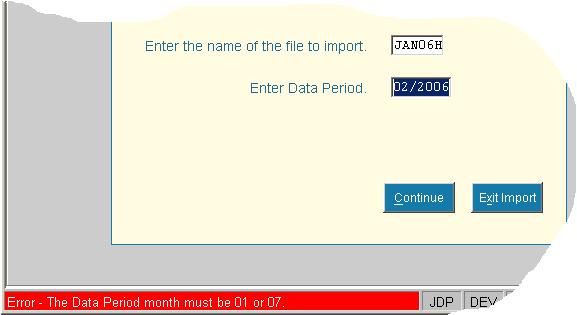

Since the incoming data covers a six month period beginning in either January (01) or July (07), the date entered for the period is the beginning month for the period. Consequentially the date entered can only be 01/ccyy or 07/ccyy (where ccyy is the century and year). If the period date (semester) entered is invalid you will see an error message in the Status line of your Appx window.

Since the incoming data covers a six month period beginning in either January (01) or July (07), the date entered for the period is the beginning month for the period. Consequentially the date entered can only be 01/ccyy or 07/ccyy (where ccyy is the century and year). If the period date (semester) entered is invalid you will see an error message in the Status line of your Appx window.

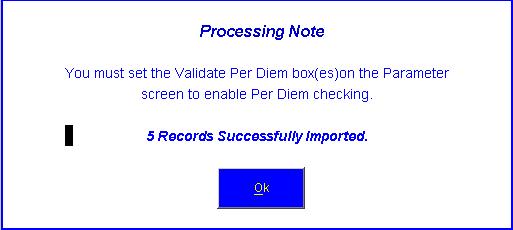

When the file is successfully imported into the Medicaid Reconciliation system, the following message will be displayed.

When the file is successfully imported into the Medicaid Reconciliation system, the following message will be displayed.

The message will tell how many records were imported and reminds you to set the Validate Per Diem box(s), either Hospital and/or HMO to Yes (checked) on the Parameter File Maintence screen. See Activating Per Diem Editing below for instructions on setting these fields on the parameter screen.

You may import the same period again if the State has sent a new or corrected file. Simply follow the same instructions except when the system detects the same period on file a warning message will be displayed, see following example. If you click the Continue button, the system will replace the existing data with the new file.

The message will tell how many records were imported and reminds you to set the Validate Per Diem box(s), either Hospital and/or HMO to Yes (checked) on the Parameter File Maintence screen. See Activating Per Diem Editing below for instructions on setting these fields on the parameter screen.

You may import the same period again if the State has sent a new or corrected file. Simply follow the same instructions except when the system detects the same period on file a warning message will be displayed, see following example. If you click the Continue button, the system will replace the existing data with the new file.

To delete a per diem semester (period) see Delete a Per Diem Data Period on the Special Functions Menu.

To delete a per diem semester (period) see Delete a Per Diem Data Period on the Special Functions Menu.

Verify Per Diem File (Future Release)

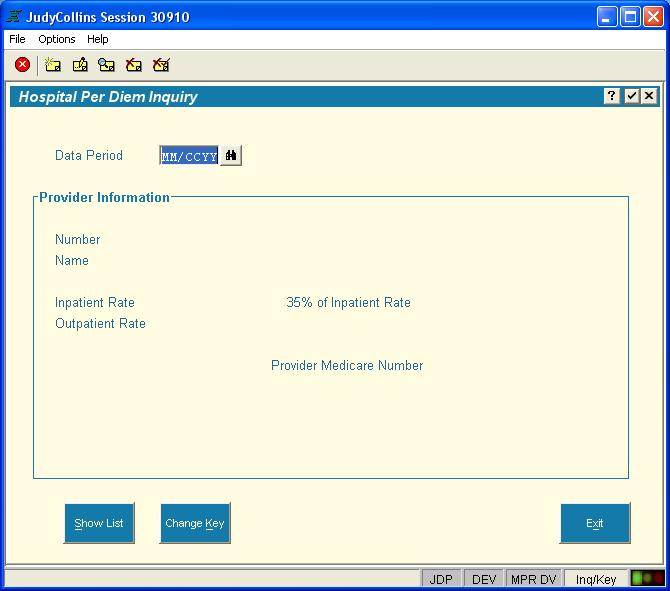

This process will use the current date and check for all the semesters that should be in the per diem file.Per Diem Inquiry

If you wish to view the per diem information that has been calculated and is currently residing in your system you can click this button then specify the semester you wish to look at.Figure: Per Diem Inquiry Screen

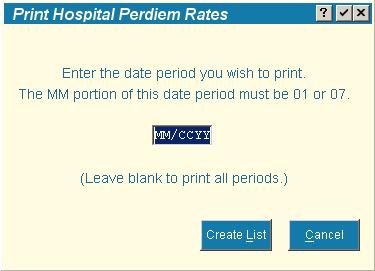

Per Diem List

This function will list the per diem data that is stored in your system. Enter the Data Period you wish to print and click Create List. Leave the Data Period blank to get a listing of the entire Per Diem file. After clicking Create List, the standard Appx Print Disposition screen will appear. Enter any specific instructions for the printed output and continue. The data on the Per Diem file is a combination of the actual data from the import file (Provider Number, Inpatient Rate, and Provider Name) and data the MPR system has added (Data Period and 35% of Inpatient Rate). The 35% rate is calculated during importing and is not present in the download file from the State. The amount on the bill is compared to 35% of the inpatient rate.

The data on the Per Diem file is a combination of the actual data from the import file (Provider Number, Inpatient Rate, and Provider Name) and data the MPR system has added (Data Period and 35% of Inpatient Rate). The 35% rate is calculated during importing and is not present in the download file from the State. The amount on the bill is compared to 35% of the inpatient rate.

Activating Per Diem Editing

After you have completed importing the Per Diem data for the appropriate range of dates the Medicaid Reconciliation system needs to be instructed to start editing incoming hospital/HMO records while creating the exception list. This is accomplished on the Parameter File Maintence screen. There are two fields which control if Per Diem is edited on the incoming bill, Validate Hosp Per Diem and Validate HMO Per Diem. You can set either or both. If neither is checked then incoming billing records will not be edited for Per Diem violations. If Per Diem is activated and the calculated Per Diem on the bill is not equal to the established Per Diem value, the billing record will be listed on the exception report. You can have the system not list billing records as exceptions when the calculated Per Diem is less than the set Per Diem rate. Check Allow Amounts Less Than Per Diem to apply this edit. The following example shows the new flags on the Parameter File Maintence screen. For illustration purposes the flags are all set to Yes (checked means yes). Initially theses flags will be set to No (blank, not checked).Reporting

The reports available on this menu are for listing data from the current reconciliation cycle.Print Exception List – Short Format

This report lists exception records from the current cycle. Just the basic information is shown on this report.Print Exception List – Long Format

This report lists exception records from the current cycle. The report includes most of the fields in the billing record for each client. This report emulates the printed bill that you may or may not get from the State.Medicaid Payment File Recap

This process prints a summary list of the current batch you are reconciling. This report shows client information, payment code, and amounts either paid or denied.Transaction History List

This function lists a specified client’s payment history.Bill Processing

Reconciliation Overview

The electronic bill is available to Florida Counties each month on the AHCA web site. You download the bill from the web site, save it on your computer, and using the Appx MPR system import the bill for processing. The bill contains six categories of data (billing types); Nursing Home (NO) Nursing Home Adjustments (NZ) Hospital (HO) Hospital Adjustment (HZ) HMO (LO) HMO Adjustments (LZ) Each record in the bill contains a Payment Code. The default Payment Code of P00 indicates the county will reimburse the State for this particular client (record). All records in the monthly bill are initially coded with P00. The process of reconciling is to determine if the client is an eligible county resident. If the client is an eligible county resident nothing needs to be done to this record, however if this client is not a resident or eligibility cannot be determined then you may want to change the P00 payment code to one of the following (Denial Codes); U01 – P.O. Box or General Delivery U02 – Out of State Address (Hospital Only) U03 – Not a County Resident U04 – Recipient in State Owned Facility U05 – No COR on File U06 – Other U99 - Homeless The monthly bill may contain hundreds and hundreds of client records. With the Appx MPR system you can pre-approve clients and save their eligibility status. When the next bill is imported the list of pre-approved clients is checked against the incoming bill. If the client has been pre-approved the MPR system will pass this record on to the final step. The remaining records are exceptions. These exception records are displayed on your computer during reconciliation for you to review. The more clients you have pre-approved the fewer exception records you will have to review. The fewer the records, the faster you can reconcile the bill each month. This is particularly important with nursing home records since they make up the majority of the records in the bill and because they typically re-occur each month. There are two ways of pre-approving a client. Both methods involve creating a Certificate of Residency record (COR) in the MPR system and coding that COR as eligible. See below for details on how to create a COR record. As you review each exception record, you determine the clients’ eligibility per your counties requirements. If the client is not eligible then you change the Payment Code accordingly. All records are assumed to be paid unless you change the payment code. There is a function in the MPR system that will automatically change the Payment Code if there is not a COR record on file for this client. Although the Payment Code has been changed, these records are still displayed on the exception list for your review.Download the monthly bill

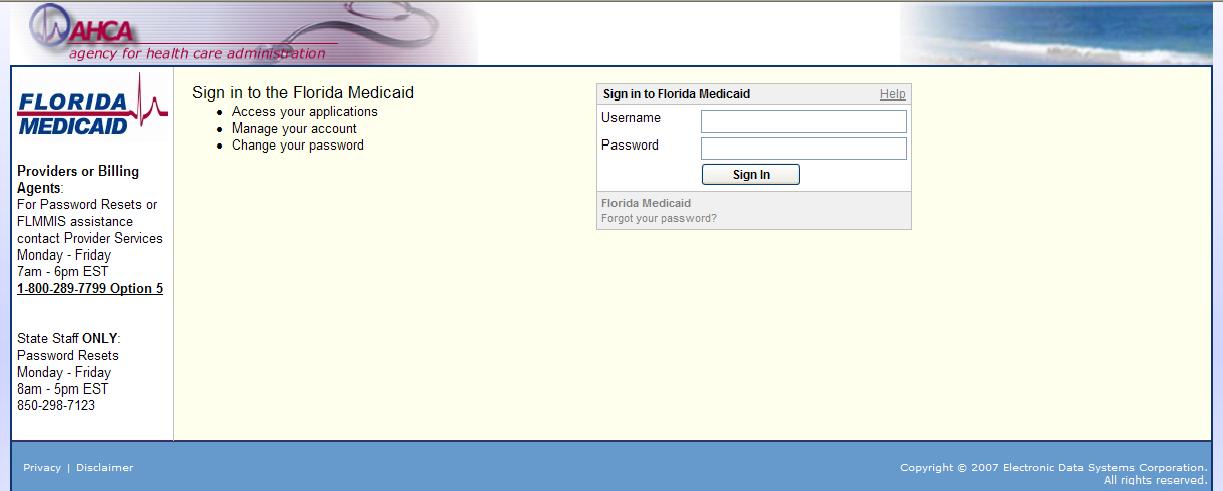

Monthly billing files must be downloaded and imported into the MPR system. Once the file is imported into the APPX system, the billing reconciliation process can begin. In order to gain access to the Florida Medicaid internet site for downloading the electronic billing file you must have a valid Username and Password. To obtain a Username and Password please call AHCA at 1-850-298-7123. Appx Software does not provide access to this web site. When you have a username and password, go to https://home.flmmis.comFigure: AHCA Login Screen

Enter your username and password and click Sign In. These fields are case sensitive.

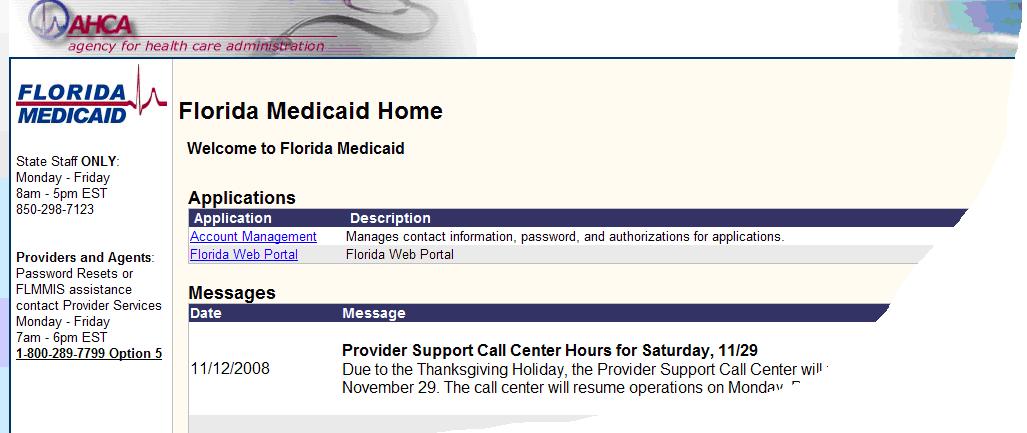

After entering your user id and password you should get a page that looks similar to the illustration above. Click on the blue words “Florida Web Portal”. The following page is displayed.

After entering your user id and password you should get a page that looks similar to the illustration above. Click on the blue words “Florida Web Portal”. The following page is displayed.

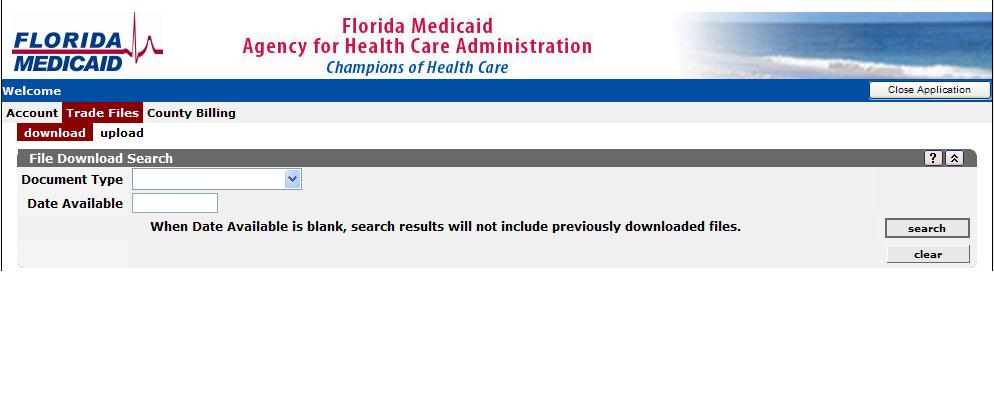

Hover your mouse pointer over the words “Trade Files” and you will see drop down with two selections, “download” and “upload”, as shown in the following illustration.

Hover your mouse pointer over the words “Trade Files” and you will see drop down with two selections, “download” and “upload”, as shown in the following illustration.

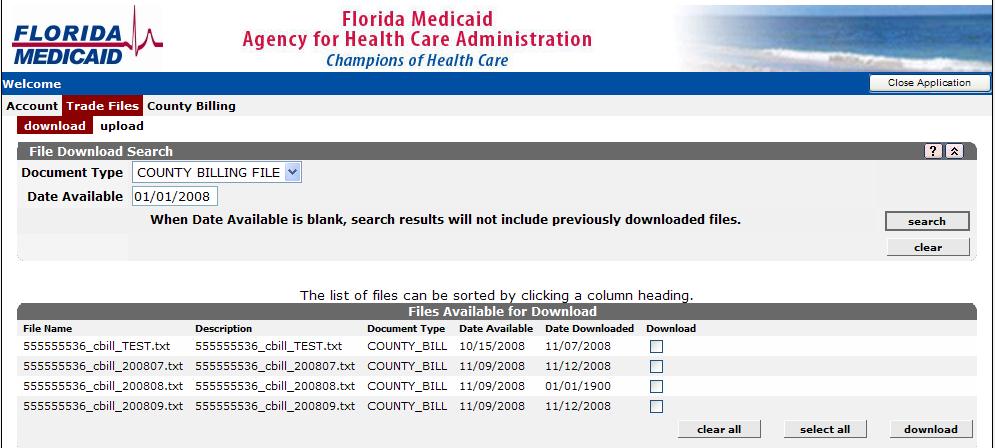

Click “download” and the following screen will be displayed.

Click “download” and the following screen will be displayed.

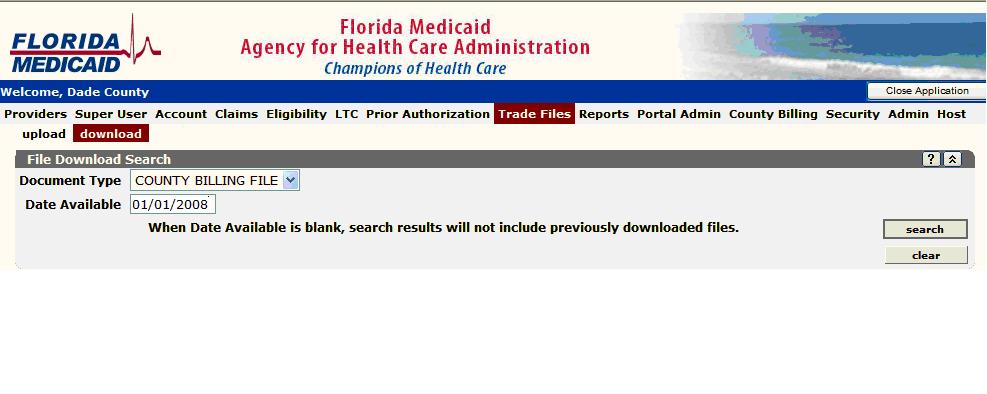

This screen asks you to enter information to build a list of files that are available for downloading. Click on the down arrow in the field Document Type and select “COUNTY BILLING FILE”. The Date Available field has two purposes. If you enter a date (MM/DD/CCYY), the only files that will be listed are those that became available from that date forward. If the date is blank, all the files that you have not downloaded are displayed. Note that if a date is entered, you may see files that you have already downloaded. Those files will have a download date associated with them. Example:

Click on the “search” button after fields are entered.

This screen asks you to enter information to build a list of files that are available for downloading. Click on the down arrow in the field Document Type and select “COUNTY BILLING FILE”. The Date Available field has two purposes. If you enter a date (MM/DD/CCYY), the only files that will be listed are those that became available from that date forward. If the date is blank, all the files that you have not downloaded are displayed. Note that if a date is entered, you may see files that you have already downloaded. Those files will have a download date associated with them. Example:

Click on the “search” button after fields are entered.

Figure: AHCA Web Site for Selecting Monthy File (Bill)

The above illustrates the results of a search for 01/01/2008 (test data). Bills that are available for download are listed. The File Name, Description, the Document Type, Actual Date Available, and the Date this file was previously Downloaded, if applicable, is shown. Use this list to select the file you wish to download and click the “download” button in the lower right corner.

Do not download more than one file at a time.

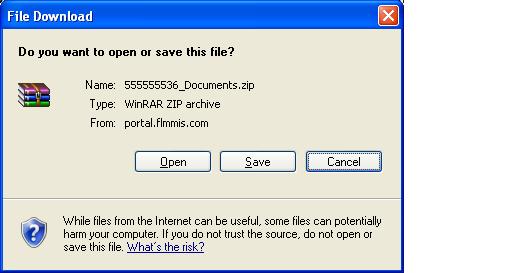

Downloading creates a single file. Selecting multiple files for downloading creates a single file that will contain data from different months, not a good thing for reconciliation. You can download one file, save it locally then, while on this web page, download another and save it, presumably to another file name. Each monthly billing file represents a “batch” to the MPR system. After clicking the download button you will get a screen pop-up similar to the following; Click Save. The Save As windows is displayed.

Click Save. The Save As windows is displayed.

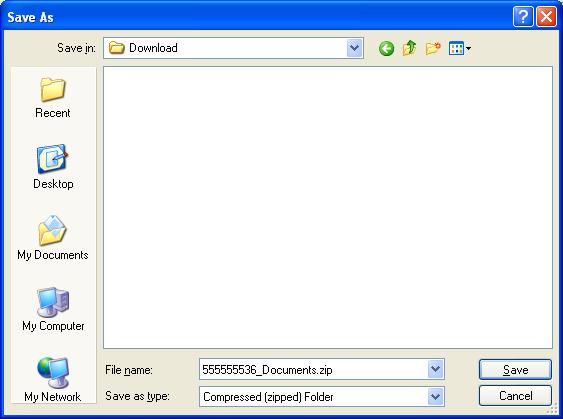

From the Save In field, navigate to the Appx Download directory. Don’t change the file name yet, we’ll get to that in the next step. The path may be similar to Appx/data/…/MPR/Download. Click Save. This file must go into the Download directory.

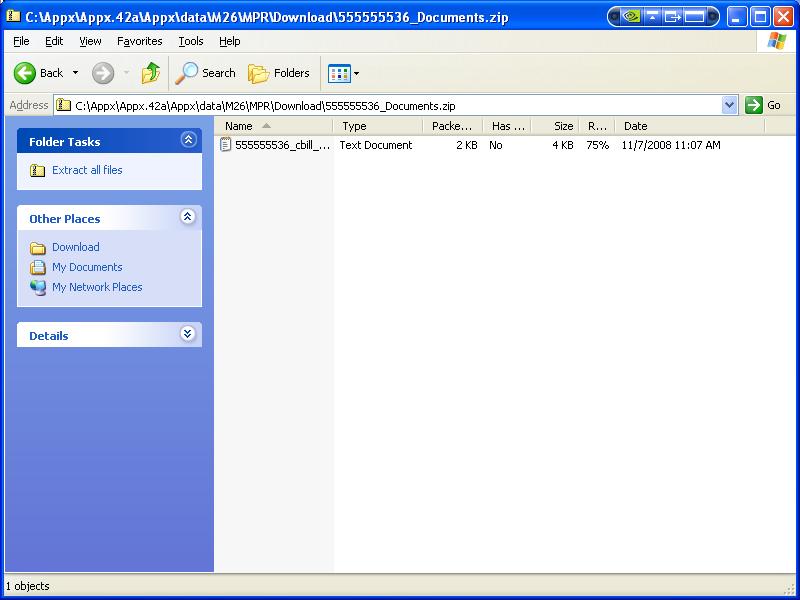

The above step saved a compressed copy of the file, note the extension .zip. You need to uncompress the file and name it using the Appx batch naming convention, MMMYYP.txt. You should have the software on your computer to uncompress or “un-zip” the file. To un-zip the file open Windows Explorer and go to the Download directory a double click on the file you just saved, 555555536_Documents.zip in this example. The following screen or similar is displayed:

If you need help with this step, please call your local IT department. Appx does not include software for un-zipping a file. Un-zipping software should be installed on your computer by default. Your IT department might have disabled this software or installed a different version. The following screen shots are from Microsoft Windows XP Professional Version 2002 Service Pack 2.

From the Save In field, navigate to the Appx Download directory. Don’t change the file name yet, we’ll get to that in the next step. The path may be similar to Appx/data/…/MPR/Download. Click Save. This file must go into the Download directory.

The above step saved a compressed copy of the file, note the extension .zip. You need to uncompress the file and name it using the Appx batch naming convention, MMMYYP.txt. You should have the software on your computer to uncompress or “un-zip” the file. To un-zip the file open Windows Explorer and go to the Download directory a double click on the file you just saved, 555555536_Documents.zip in this example. The following screen or similar is displayed:

If you need help with this step, please call your local IT department. Appx does not include software for un-zipping a file. Un-zipping software should be installed on your computer by default. Your IT department might have disabled this software or installed a different version. The following screen shots are from Microsoft Windows XP Professional Version 2002 Service Pack 2.

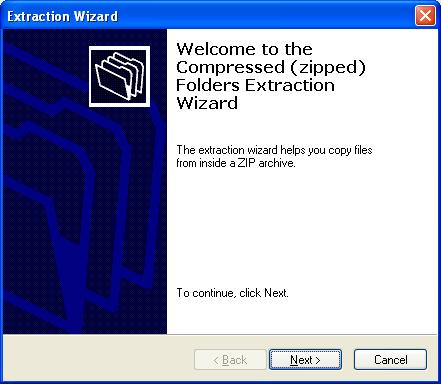

To un-zip the file simply click on the word “Extract all files” under Folder Tasks in the left margin. The Extraction wizard starts. Click Next to proceed through the wizard.

Note; you may be able to open this file using Notepad. If you can, simply click on File > Save As and save the file in the Download directory. Be sure to name the file using the proper naming convention, [[#Name and save the bill in the Download Folder][defined here]

To un-zip the file simply click on the word “Extract all files” under Folder Tasks in the left margin. The Extraction wizard starts. Click Next to proceed through the wizard.

Note; you may be able to open this file using Notepad. If you can, simply click on File > Save As and save the file in the Download directory. Be sure to name the file using the proper naming convention, [[#Name and save the bill in the Download Folder][defined here]

The Extraction Wizard starts.

The Extraction Wizard starts.

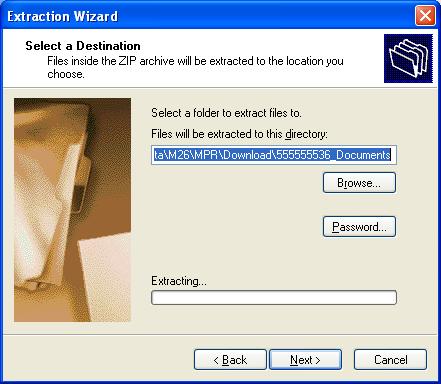

Select (Browse) to the Appx Download directory.

Select (Browse) to the Appx Download directory.

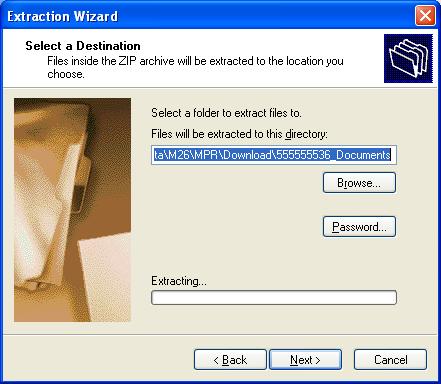

Click Finish with the “Show extracted files” option checked.

Click Finish with the “Show extracted files” option checked.

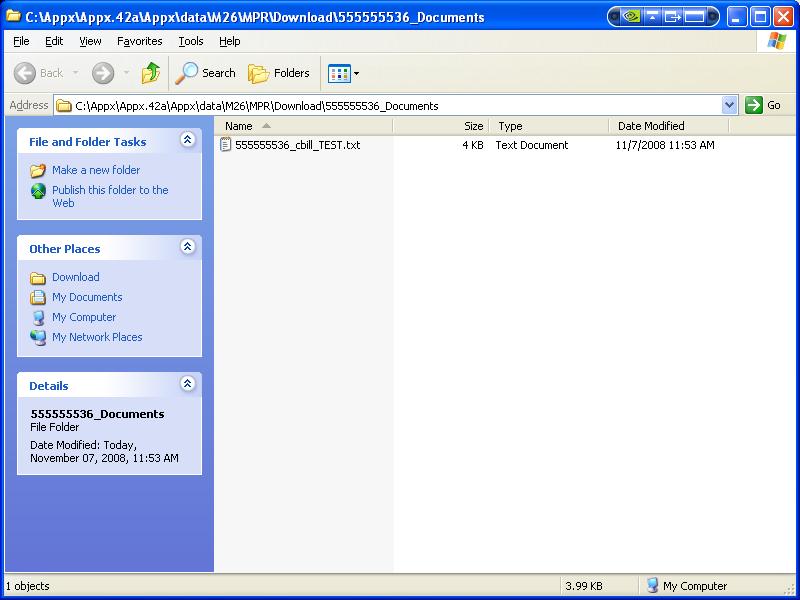

When Windows Explorer is re-displayed you will see the extract file. Make certain the file is in the Appx Download directory.

When Windows Explorer is re-displayed you will see the extract file. Make certain the file is in the Appx Download directory.

Name and save the bill in the Download Folder

Now rename the uncompressed file. Use the MMMYYP.txt format where P indicate this is the Primary bill. Since we downloaded the file into the Download directory everything stayed within that directory. You may have to move the file from a sub-folder that the Extraction Wizard created. The MMMYYP.txt file must be in the Download directory. At this point you can go back to the Florida Medicaid page and download another file and repeat this step for the next file if you wish. The compressed folder and file(s) will remain on your system. The next time you download you might get a message during this process indicating that a “file already exist”. If you have un-zipped the prior file and named it to its proper batch name you can re-use the zip folder and file name. If you are finished downloading you can close the web page and proceed to the Appx reconciliation menu.Update COR File

Start Appx and the MPR system and navigate to the Medicaid Reconciliation Menu. When you import a bill into the MPR system the exception list is created. Therefore before importing the bill you should add or modify any COR records so that those updates can be used during the import.Move Billing File To Server

If you saved the downloaded file to the Download folder on the Appx server you can skip this step. If you saved the downloaded file on your desktop you can use this function to move it to the server where it will be placed in the Download directory. If the file is not in the Download directory you will not be able to import it.List Raw File To Verify

This process list the billing file. Review the on-screen list making sure the payment code field is P00 and the clients name is readable. If there was a problem downloading the file these fields will be garbage. If that’s the case call Appx support at 1-800-879-2779 for assistance. After the List Raw File To Verify has executed a green bar will appear on the bottom of the menu indicating a reconciliation cycle has begun and will identify the batch name of the billing file. If a cycle has started then it must be processed before another file can be imported. Only one user at a time should be reconciling a batch. The buttons in this section are activated by the system. If the button is gray then you cannot invoke that process. As you progress from step to step the buttons will automatically activate for you to continue the reconciliation cycle.Import Payment File and Build Exception List

This function processes the bill and divides it into records that eligible and those that are exceptions. Eligible records are passed to the final step.Review Exception List and Flag Denials

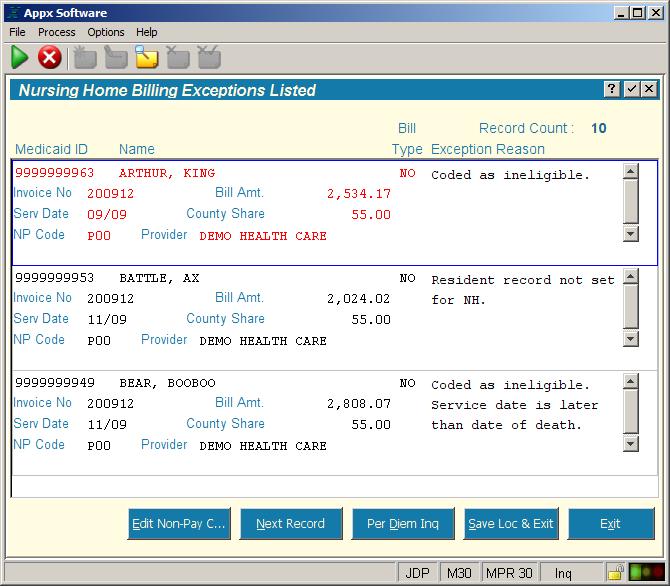

This section of the menu has four buttons, Review All Exceptions, Nursing Home Only, Hospital Only, and HMO Only. These four functions display the corresponding exceptions list. Note the exception list category is displayed in the window title bar, example below. The list shows basic information for each client and the reason(s) this record is on the exception list. Three records at a time are displayed on the exception list and as you go from record to record the list will cycle through all the records.

These four functions display the corresponding exceptions list. Note the exception list category is displayed in the window title bar, example below. The list shows basic information for each client and the reason(s) this record is on the exception list. Three records at a time are displayed on the exception list and as you go from record to record the list will cycle through all the records.

As mentioned earlier, the default Payment Code (NR Code) is P00. P00 is the code that says you are going to pay your county’s share of this claim. The NR Code may also be automatically set by the MPR system depending on the No COR NP Code setting on the Parameter File Maintence screen. This No COR NP Code is typically set to U05, No COR on File. You can still change this Payment Code if you wish.

The field text is black if this record is not active. If the record is active, you'll see the blue boarder arount the record and the text will be red. If this is a re-bill record, the word Re-bill will be printed next to the Invoice No field and the text will be blue instead of black, and majenta instead of red. The blue boarder will not change on re-bill records.

To change a payment code and/or to see the complete detail for the current record click the Edit Non Pay Code button near the bottom of the screen. The follow screen will appear;

As mentioned earlier, the default Payment Code (NR Code) is P00. P00 is the code that says you are going to pay your county’s share of this claim. The NR Code may also be automatically set by the MPR system depending on the No COR NP Code setting on the Parameter File Maintence screen. This No COR NP Code is typically set to U05, No COR on File. You can still change this Payment Code if you wish.

The field text is black if this record is not active. If the record is active, you'll see the blue boarder arount the record and the text will be red. If this is a re-bill record, the word Re-bill will be printed next to the Invoice No field and the text will be blue instead of black, and majenta instead of red. The blue boarder will not change on re-bill records.

To change a payment code and/or to see the complete detail for the current record click the Edit Non Pay Code button near the bottom of the screen. The follow screen will appear;

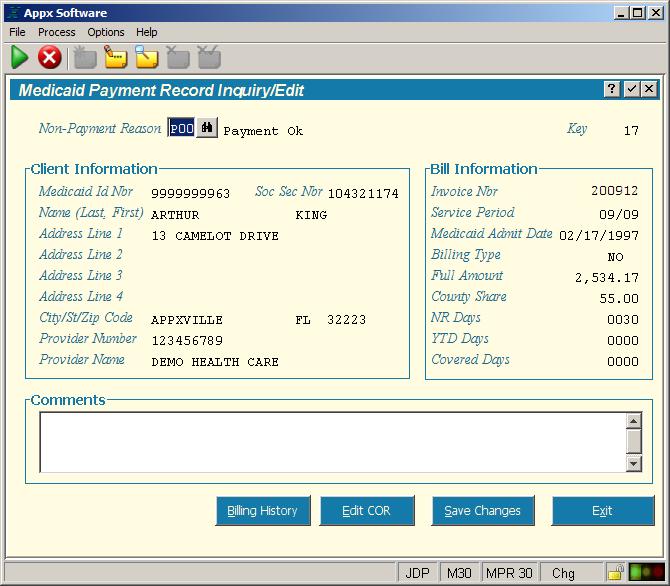

From the detail screen you can review the data to and change the Payment Code if needed. Click Save Changes to save the altered Payment Code. You will return to the Exception List screen and will be on the next record. Determining whether a client is eligible or not, is completely under your control.

From the detail screen you can review the COR record you have on file for this client by clicking the Edit COR button. If this client does not have a COR, you can click Add COR (Nursing Home or Hospital) and the MPR system will take you to the COR entry screen where you can change the eligibility status. The advantage to adding COR’s at this point, is that most of the fields are populated from the billing record. This will save you a lot of time and since you have to determine if this person is eligible right now, the new COR can be updated at the same time.

On the COR there is a place for Comments. Enter up to 180 characters. This information is saved in the COR which is a permanent file. The billing detail file also has a place for Comments. Anything entered in the Comments section on the billing record will be saved in history but will not be displayed if this client records appears in the next billing cycle.

Continue to review each record on the exception list. When you are finished with all the records, proceed to the next category of data or next step.

The exception list will always start listing records in Last Name order starting with the first client in the file. If you want to go to a specific record on the list press the F11 key. The list now is blank. You are in “key entry mode”. Notice that the binoculars are on the Medicaid ID field. If you know the clients Medicaid ID number you can enter it then press the Enter key. Clicking the binoculars will show you the records sorted in Medicaid ID number order. You can scroll down the list and when you find the one you want simply click on it and the exception list will start on that record. If you would rather search by Name, after pressing F11 press F3 and a Select Path screen will pop up with all the search fields listed. With your mouse, click on the words Recip Name. The black box should move to the R in the Recip Name line. Press the Enter key and you will return to key entry mode on the exception list but now the search field is set to Name. Now you can enter the clients name (last, first). If you want to start the list with the all the clients whose last name starts with the letter T, type T and press Enter.

When you exit Appx and return at a later time the exception list will return to listing records in last name order starting at the beginning of the file. If you are in the middle of reconciling a bill and need to exit the system, you can ‘tag’ the current record. When you return to reconciliation at a later time, you can ‘jump’ directly to this tagged record.

From the detail screen you can review the data to and change the Payment Code if needed. Click Save Changes to save the altered Payment Code. You will return to the Exception List screen and will be on the next record. Determining whether a client is eligible or not, is completely under your control.

From the detail screen you can review the COR record you have on file for this client by clicking the Edit COR button. If this client does not have a COR, you can click Add COR (Nursing Home or Hospital) and the MPR system will take you to the COR entry screen where you can change the eligibility status. The advantage to adding COR’s at this point, is that most of the fields are populated from the billing record. This will save you a lot of time and since you have to determine if this person is eligible right now, the new COR can be updated at the same time.

On the COR there is a place for Comments. Enter up to 180 characters. This information is saved in the COR which is a permanent file. The billing detail file also has a place for Comments. Anything entered in the Comments section on the billing record will be saved in history but will not be displayed if this client records appears in the next billing cycle.

Continue to review each record on the exception list. When you are finished with all the records, proceed to the next category of data or next step.

The exception list will always start listing records in Last Name order starting with the first client in the file. If you want to go to a specific record on the list press the F11 key. The list now is blank. You are in “key entry mode”. Notice that the binoculars are on the Medicaid ID field. If you know the clients Medicaid ID number you can enter it then press the Enter key. Clicking the binoculars will show you the records sorted in Medicaid ID number order. You can scroll down the list and when you find the one you want simply click on it and the exception list will start on that record. If you would rather search by Name, after pressing F11 press F3 and a Select Path screen will pop up with all the search fields listed. With your mouse, click on the words Recip Name. The black box should move to the R in the Recip Name line. Press the Enter key and you will return to key entry mode on the exception list but now the search field is set to Name. Now you can enter the clients name (last, first). If you want to start the list with the all the clients whose last name starts with the letter T, type T and press Enter.

When you exit Appx and return at a later time the exception list will return to listing records in last name order starting at the beginning of the file. If you are in the middle of reconciling a bill and need to exit the system, you can ‘tag’ the current record. When you return to reconciliation at a later time, you can ‘jump’ directly to this tagged record.

To ‘tag’ a record location on the exception list, press the Save Location and Exit button instead of clicking the Exit button. The system will remember the current record. When you return to the exception list and wish to ‘jump’ to where you left off, click Go to Saved Location. Note: the Go to Saved Location button will only be displayed if you have previously exited by clicking Save Location and Exit. The system will remember this tagged record until you tag another or start a new bill. You can tag one record per billing category, all, nursing home, hospital, or HMO.

The buttons in this section will remain active throughout the rest of the reconciliation cycle. This allows you to start reconciling, leave Appx and return later to continue working. Once you view any exception list the Post Reconciled Bill button becomes active. Make sure you have reconciled the entire bill before posting.

To ‘tag’ a record location on the exception list, press the Save Location and Exit button instead of clicking the Exit button. The system will remember the current record. When you return to the exception list and wish to ‘jump’ to where you left off, click Go to Saved Location. Note: the Go to Saved Location button will only be displayed if you have previously exited by clicking Save Location and Exit. The system will remember this tagged record until you tag another or start a new bill. You can tag one record per billing category, all, nursing home, hospital, or HMO.

The buttons in this section will remain active throughout the rest of the reconciliation cycle. This allows you to start reconciling, leave Appx and return later to continue working. Once you view any exception list the Post Reconciled Bill button becomes active. Make sure you have reconciled the entire bill before posting.

Edit Payment Records/Change Payment Code

This function lets you go to any record in the bill, including records that were not listed on the exception list. If for any reason you need to override the P00 on a record that was pre-approved you can change it using this function.Trail Balance (Future Release)

This process will display a summary of the current cycle bill. The report shows each billing category and the number and amount of approved and denied payments. Use this to evaluate the status of your current reconciliation cycle. The trial balance is not intended to be printed on paper, just displayed on the screen.Post Reconciled Bill

When you have completed reconciling all the records in Nursing Home, Hospital, HMO, and are satisfied with the results of the trial balance, you can Post the bill. Once the bill is posted you cannot alter the Payment Code or return to viewing the exception list. When you post the bill the MPR system creates a new billing file with the exact same name as the current billing file but puts it in the Upload directory on your server. The new file in the Upload directory contains all the billing records including the records you denied. A summary letter is displayed on your screen which is intended to be printed for your records. This report is similar to the trail balance but is formatted to provide audit information for this reconciliation cycle. The MPR system also adds the billing records to the history file. The history file is actively used during reconciliation to view past payments from the detail client screen. History is also used to create reports. When the bill has been completely reconciled (Posted) you must upload the updated file the State. The download and upload steps are performed using your internet browser, not the Appx system. Downloading and Uploading as well as Internet access may be restricted depending on your county’s policy. After posting the MPR system resets itself in preparation for the next cycle.How to upload the reconciled bill

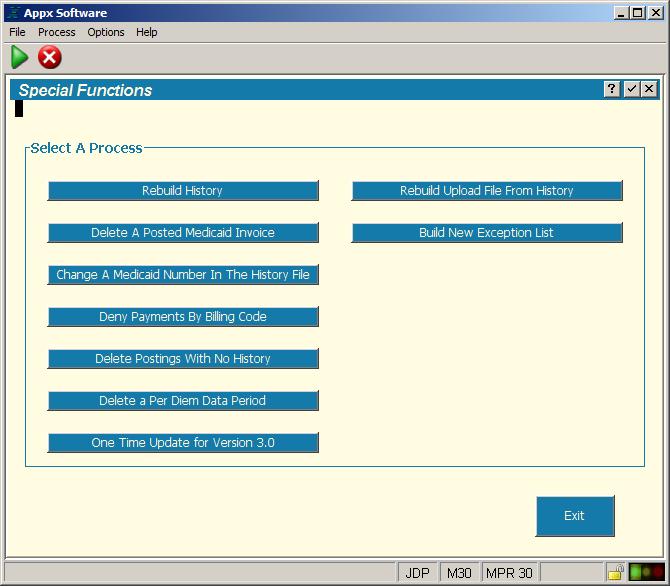

After the summary letter gets approved for payment you need to send the reconciled bill back to the State. The reconciled bill has been created by the Appx system and is residing in the Upload directory under the Appx folder on your server. The file name will be the same name you gave the bill when you Downloaded it, for example; OCT08P .txt. As you would expect, the upload process is similar to the download process. You are just selecting the file from the Upload directory rather than the Download. If you upload the file in the Download directory then what ACHA receives is the same data you downloaded. Nothing will be changed. If you get a call to that effect, chances are you’ve made this mistake. All that you need to do is upload the file from the proper directory, you do not need to reconcile again. If the file size is greater than 3 megabytes it will have to be compressed before uploading it. Invoke the compression utility that is available on you computer and compress the file. Your IT folks should be able to help you with this process. As of this writing, all files have been under 3 megabytes. Log into the Florida Medicaid website and select “upload” from the Web Portal > Trade files page. Click on the browse button and navigate to the compressed file and select it. Once selected complete any other information on the web page and click the upload button. The file you selected for uploading will still be in the Upload directory on your computer after the transfer. If you need to send this file again, simply repeat the upload process. It is a good idea to keep these files because they can be used to recreate your history files if necessary.Special Functions Menu

The Special Functions menu contains processes to assist you in maintaining your system or to perform batch data processing.Figure: Special Function Menu

Rebuild History

This function will rebuild the history file from the reconciled billing files in the Upload directory.Delete A Posted Medicaid Invoice

If you imported the wrong billing file (invoice) by mistake, you can delete the batch with this function and start over.Change A Medicaid Number In The History File

If a client has their Medicaid ID number changed, this process will update the history file with the new ID number. Normally the history file is not modifiable.Deny Payments By Billing Code

This is a handy tool that will let you deny an entire group of billing records. For example, if you wish to deny all HMO records in the current cycle, you can use this function to select HMO records and then identify the denial code you wish to put on these records. This only affects the currently imported batch.Delete Posting With No History

Use this to remove batches that were started and never posted.Delete a Per Diem Data Period

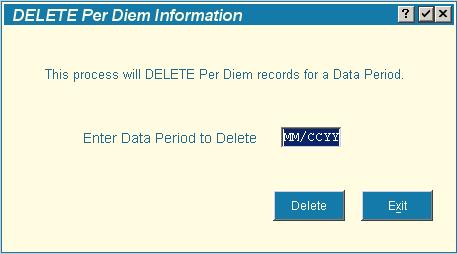

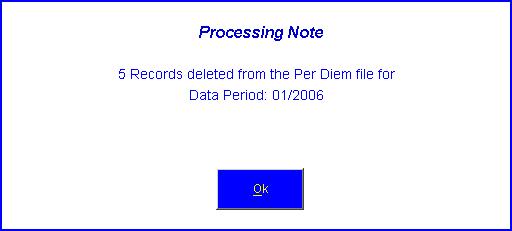

Use this function to delete a per diem semester. From the Special Functions menu, click on Delete a Per Diem Data Period. The following screen will be displayed. Enter the two digit month (MM) and the four digits century and year (CCYY) and click the Delete button. The month entered must be 01 or 07. If you enter a data period that does not exist on the Per Diem file an error message will be displayed. You must click the Delete button to execute this function. Pressing ENTER or the Exit button will not delete the records. If the delete is successful you will see a message indicating how many records were deleted, see example. You can only delete one period at a time.

Enter the two digit month (MM) and the four digits century and year (CCYY) and click the Delete button. The month entered must be 01 or 07. If you enter a data period that does not exist on the Per Diem file an error message will be displayed. You must click the Delete button to execute this function. Pressing ENTER or the Exit button will not delete the records. If the delete is successful you will see a message indicating how many records were deleted, see example. You can only delete one period at a time.

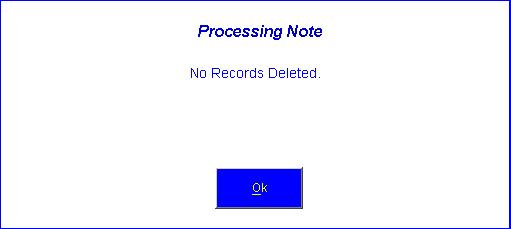

If no records were deleted, the following message will be displayed. You will see this message if you click the Exit button or pressed the ENTER key on the application screen.

If no records were deleted, the following message will be displayed. You will see this message if you click the Exit button or pressed the ENTER key on the application screen.

Rebuild Upload From History

Using the history file in the MPR system this process can rebuild the file(s) in the Upload directory.Build New Exception List

If you import a bill and then realize that the COR file needs to be updated to reduce the number of exceptions you can invoke this special process. Please note any changes to this batch will be lost if you invoke this process. One handy way of using this function is to import a bill, go thru it and create COR’s for all the relevant records. Then invoke this process and the system will use the new records in the COR to reduce the number exceptions . The Exit button will take you back to the MPR main menu.Terminology

Non-payment code

The non-payment code, also referred to as NP Code or denial code, is a three character code that specifies the reason the client record is being denied. When the county bill is downloaded from the State web site all records are coded with a non-payment code of P00. P00 indicates that the county will reimburse the State for this client record. The process of reconciliation is to look at billing records and make a determination based on the data presented whether or not this client is eligible in your county. If this client is ineligible then the P00 code needs to be changed to one of the following codes; U01 = P.O. Box or General Delivery U02 = Out of State Address (Hospital Only) U03 = Not a County Resident U04 = Recipient in State Owned Facility U05 = No COR on File U06 = Homeless U99 = OtherException list

The exception list is an on-line display of monthly billing records that failed the exception processing logic. The goal of the Medicaid Reconciliation system is to automatically accept pre-verified Medicaid clients and to list only those records that need manual verification. The key to the pre-verification process is having a COR or Residency record on file.Exception reason

The APPX Medicaid reconciliation system will read each record from the imported monthly billing file and check the record for several criteria. If the record fails verification it will be listed on the exception report along with the reason.

COR - Certificate of Residency

Certificate of residency records are distributed by ACHA for eligible Medicaid recipients. These records are imported into the APPX Medicaid Reconciliation System. After they are are imported, the system list new records for you to approve or deny. You must look at each COR to ensure it is a valid county resident. If a COR exist for a billing record and is coded as eligible, the monthly billing payment record will not be listed as an exception (barring any other errors).

Residency record

A record that is manually entered into the COR file for a service provider. ACHA does not distribute COR type records for providers, however, you can manually enter a Residency record or “hospital COR”. If a residency record is on file and the billing information matches, the billing record will not be listed on the exception report.

Reconciliation Cycle

A Reconciliation Cycle begins when a file that you have downloaded is imported into the MPR system for processing. Each bill will be assigned a unique batch id. Reconciliation is a series of processing steps. Only one Reconciliation Cycle can be active at a time and must be completed (Posted) to begin a new cycle.Posting

When a bill has been completely reconciled the bill must be posted. Posting will create the billing file that you will upload to the State. Posting also updates the Payment History file in the system with the current records that have been processed. After posting a new reconciliation cycle can begin.Re-bill

For the purposes of the MPR system, re-bill means the invoice date on the record does not equal the date indicated by the batch name.AHCA

Florida Agency for Health Care Administration.Exception Reasons

These messages are printed on the exception report and indicate why that client is listed.Not this county

The county code in the Download data file for this record does not match the county code in your Agency Options parameters.No COR on file. -- NP code updated

There is no Certificate of Residency record (COR) on file for this nursing home client. The NP Code is set to the code defined on the Parameter File Maintence screen in the field “No COR NP Code”.Resident record not set for NH

A Certificate of Residency record (COR) exists for this nursing home client but the “Nursing Home COR?” field is not checked. When this field is not checked the COR exists but is inactive.Missing required value(s)

For this Hospital or HMO client either the Covered Days or County Share is missing (zero). These two items are required to calculate Per Diem. This error will only occur if “Validate Hosp Per Diem” and/or Validate HMO Per Diem” is checked on the Parameter File Maintence screen.Per Diem values not found

For this Hospital or HMO client the system could not find a Per Diem record for the given provider and/or for the specified service period. This error will only occur if “Validate Hosp Per Diem” and/or Validate HMO Per Diem” is checked on the Parameter File Maintence screen.Per Diem mismatch

The calculated Per Diem rate for this Hospital or HMO client during the given service period does not equal the value specified in the Per Diem file for this provider. This error will only occur if “Validate Hosp Per Diem” and/or Validate HMO Per Diem” is checked on the Parameter File Maintence screen. There is a button on the exception list screen that will display the valid per deim values for this provider.Resident hospital flag not set

For this Hospital or HMO client there is a Resident record on file (referred to as a Hospital COR) but the “Address Verification” field is not checked. When this field is not checked the Resident record exists but is inactive.Address does not match

The Hospital or HMO provider address did not match the address in the Resident (COR) file. The address must exactly match all four lines of the address, the city and state to pass verification.No address record

There was no Resident record (Hospital COR) on file for this Hospital or HMO client.County share is more than the bill amount

The specified County share for this record is greater than the specified bill amount. This exception can occur on all record types.Unpaid record for client

For adjustment transactions (NZ,HZ,LZ), the system looks in the history file for a matching payment amount for this client. If one is found and it was paid, then the adjustment is okay. If the offset history record for this adjustment was denied this error will be listed.No record in history for credit offset

A matching history could not be found for this adjustment. This means that you have never received the payment transaction the current transaction is attempting to adjust.Adj, check for matching credit/debit bills

All adjustment records are listed as exceptions. This message is printed as a reminder to check for a matching credit/debit transaction.No eligibility code

The “Eligibility Code” is not set in the COR file for this client.Coded as ineligible

This client is coded as being ineligible for benefits and you have specified to list all records that have this Eligibility code (see Eligibility Code Maintenance function, Auto Except check box).Rebill payment previously approved

This rebill record has already been paid. There is a matching payment, P00, in the history file.Duplicate service date record in history

This non-rebill payment has already been paid for this service period.Service date is prior to medicaid admit date

The service date specified is before the “Admit Date” on the COR for this client.Service date is later than date of death

The service date specified is after the “Date of Death” on the COR for this client.Service date is later than date moved out

The service date specified is after the “Moved Out” date on the COR for this client.Tips and Techniques

Known Bugs

Feature Request

You don't see something that would help you reconcile your bill each month. Let us know and we'll look at adding your suggestion in a future release.Topic revision: r18 - 2010-07-27 - JeffPrentice

Ideas, requests, problems regarding TWiki? Send feedback